In an interconnected world, dealing with different currencies shows up faster than most people expect. One trip, one overseas payment, one late-night purchase from a foreign site and suddenly numbers stop making sense. financial Currency converter tips or conversion isn’t difficult, but it is easy to misunderstand if you don’t know what’s happening behind the scenes. Having a reliable reference like calculator pro helps ground those numbers in reality, especially when rates are shifting by the minute and guesswork starts creeping in.

What is an Exchange Rate and How Does it Work?

An exchange rate is just a comparison. One currency measured against another at a specific moment in time. If one US dollar gets you 0.92 euros, that’s the rate right now, not a promise for tomorrow. These values move constantly, pushed around by inflation data, interest rate decisions, political tension, trade news, even unexpected headlines. It’s less like a fixed rule and more like a live signal reacting to the world in real time.

Understanding the “Mid-Market Rate”

Most people never see the rate banks trade with each other. That’s the mid-market rate, sitting quietly between the buy and sell prices. It’s the cleanest number you’ll get, without markups layered on top. Think of it as the baseline, similar to how a length calculator gives a neutral measurement before anyone rounds or adjusts it. Once you know this number, it becomes much easier to spot when a deal is quietly shaving value off your money.

Why You Should Avoid Airport Kiosks and Bank Fees

Airport exchange counters look harmless until you check the rate afterward. Convenience comes at a cost, and that cost is usually hidden in poor exchange values rather than visible fees. Banks do the same thing more politely. They rarely advertise how wide their margins are. Knowing the real rate beforehand shifts the balance back to you. At least then, you’re choosing convenience with open eyes instead of paying for it unknowingly.

Practical Uses for a Currency Converter

Currency conversion isn’t just for travelers. It sneaks into daily life in subtle ways. Comparing prices on international stores, tracking foreign investments, sending invoices to overseas clients, or even budgeting for subscriptions billed in another currency. Seeing numbers in your own currency makes decisions feel concrete instead of abstract. Without conversion, it’s all just foreign math floating around without context.

How to Use Our Real-Time Currency Converter

Using a converter shouldn’t feel like work. You enter an amount, choose where it’s coming from, choose where it’s going, and the answer appears. That’s it. Over time, checking exchange rates becomes almost habitual, the same way people casually check birthdays with an Age calculator. The tool isn’t the point. Awareness is.

Conclusion: Make Financially Savvy Decisions Globally

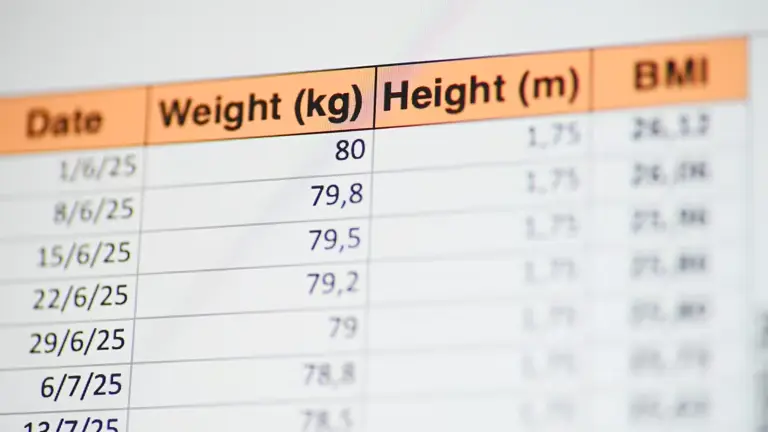

Currency exchange doesn’t need to be intimidating. Once you understand how rates move and where extra costs hide, the whole system feels less chaotic. You stop reacting and start comparing. Whether you’re spending, saving, or investing across borders, clarity matters. Tools like a BMI Calculator or a currency converter don’t make decisions for you, but they do remove the fog. And sometimes, that’s all you really need to move forward with confidence.

FAQs About Financial Currency Converter Tips

What is a financial currency converter?

A financial currency converter is a tool that shows the value of one currency in another using current or near-real-time exchange rates. It’s commonly used for trading, travel planning, and online payments.

How accurate are online currency converters?

Most Financial Currency Converter Tips are accurate for reference purposes, but the final rate you get from a bank or exchange service may include fees, margins, or a slightly different rate.

Why do exchange rates change so often?

Exchange rates change due to supply and demand, interest rates, inflation, economic data, and global events. Currency markets operate continuously, which causes frequent rate movement.

Do currency converters include bank fees?

This is one of the most important aspect in Financial Currency Converter Tips that most currency converters show mid-market rates and do not include bank or service fees. Always check with your bank or provider for the actual conversion cost.

Which rate should I trust for large conversions?

For large amounts, rely on rates from trusted financial institutions or official market data rather than a single online converter.

When is the best time to use a currency converter?

It’s best to use a currency converter before making international payments, traveling, sending money abroad, or monitoring exchange rate trends.